AI-powered delivery date estimates to boost conversion

Give shoppers peace of mind and protect and grow your bottom line

Personalized tracking experiences to build brand loyalty

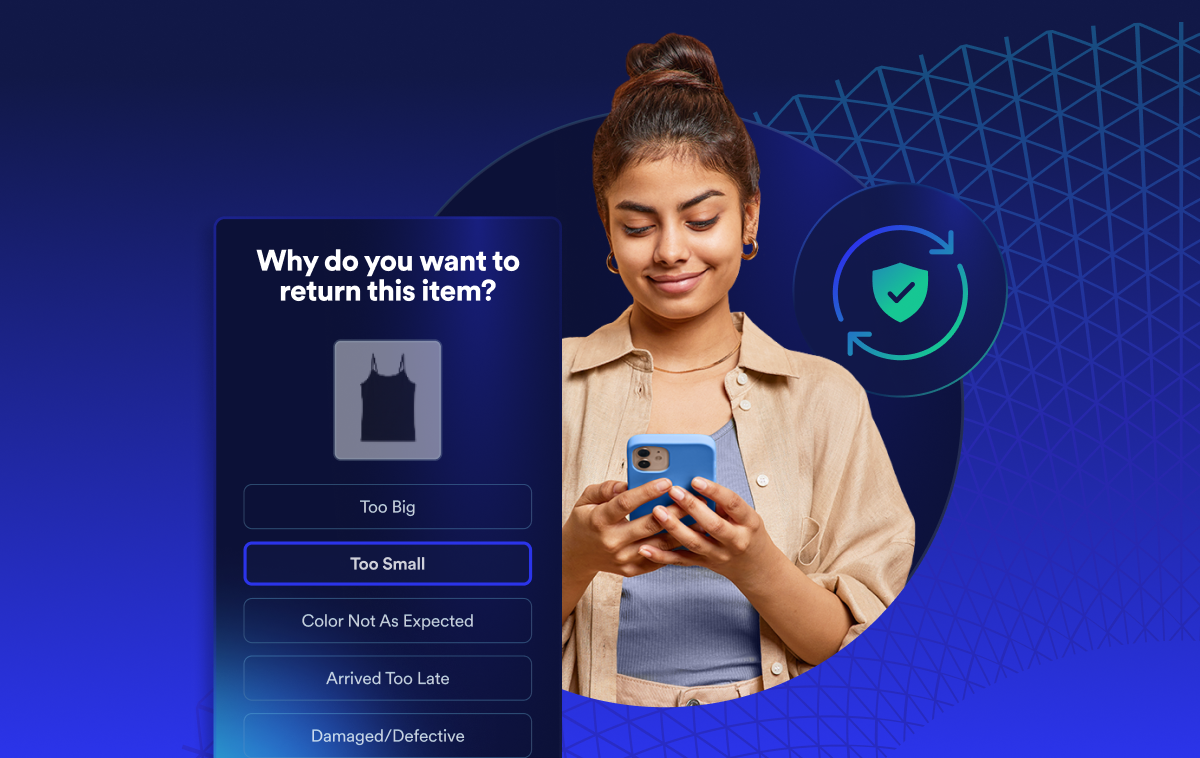

Returns and exchanges management to mitigate fraud and reward best customers

Proactive communication to drive customer lifetime value

Delivery claim management to tackle fraud and build trust

What Is Post-Purchase and Why Does It Matter?

%20(16).webp)

In ecommerce, post-purchase (or post-purchase experience) refers to every point of engagement after the customer clicks the buy button. It’s an umbrella term that covers tracking notifications; packing, shipping, and delivering an order; the returns process; feedback requests; and follow-up promotions for additional products or services.

The post-purchase experience is focused on fostering a relationship that makes the customer want to come back— increasing the customer’s net promoter store and lifetime value.

Nailing post-purchase is critical to the customer lifecycle:

A retailer that keeps a customer happy in the first 100 days of the relationship is likely to keep that customer for five years.

In this article, you’ll learn what it takes to build a great post-purchase experience that helps your retail or ecommerce brand thrive.

Post-purchase communication

Customers crave information during the post-purchase period: 83% of customers expect regular communication about their orders and 34% want that communication to come in a format other than email (text, messenger apps, or even voice-activated devices).

(What’s in it for you?—Put plainly, frequent, meaningful communication makes customers happy and minimizes strain on the customer support team.)

Standard categories of post-purchase communication include:

- Branded tracking pages

- Order confirmation

- Order cancellation

- Ready notificaiton

- Shipping notification

- Delivery variances

- Delivery notification

- Experience feedback requests

Branded tracking pages

Emails or SMS texts may work for updating a customer about the progress of their purchase, you should always create a contextual, branded tracking page for each order. With a branded tracking page, the customer can easily access the latest news about their order, regardless of where they initiate their query.

(For example, if the customer clicks on the tracking update from the order confirmation notification instead of the shipping notification, they would still be directed to the latest shipping update via the branded tracking page.)

As a bonus, retailers capture engagement metrics through branded tracking pages that extend beyond the open rates they get through email. By tracking customer click-throughs and resulting conversion rates, retailers can better understand what is bringing customers back after they’ve already made an initial purchase. Not only does this work to drive more revenue, it can enhance the customer’s overall experience with a brand, which, in turn, results in more repeat purchases.

Order confirmation

The order confirmation signals to the customer that they have successfully completed the purchase process, and assigns them an alpha-numeric order identifier. Throughout the course of the transaction, the customer should be able to use that identifier to check the status of their order or return, and pose questions to customer service.

Beyond listing the items a customer purchased and their prices, the order confirmation should set expectations for the rest of the fulfillment process, including processing time, buy online pick-up in store (BOPIS) instructions (when relevant), an estimated delivery date (if available), relevant cancellation procedures, final sale status, and return instructions.

If there’s a variance in the standard fulfillment process at the time of purchase—like backorders or delays—it should BEFORE the customer purchases and then REITEREATED in the order confirmation.

Order cancellation

No one wants to be the bearer of bad news, but retailers occasionally have to cancel a customer’s order. The retailer can soften the blow by detailing when the customer should see the charge refunded, and offering a discount and/or free/accelerated shipping on a future purchase.

If the customer bought an item on sale, and the item is expected to restock at a later date, the retailer might offer rain-check pricing. While some retailers use a cancellation communication to suggest substitute items, substitutions can be tricky given sizing, pricing, and the customer’s preferences.

Ready notification

Buy-online, pickup-in-store (BOPIS)—also known as click-and-collect or curbside pickup—continues to gain popularity: 64% of shoppers attest to using BOPIS at least once in the last two years.

The key to smooth BOPIS notification is outlining clear instructions about where the customer should go to pick up their order, what documentation they need to bring, and what they need to do to receive the order.

For example, if a retailer offers curbside service in a dense area like a shopping center, the ready notification process might include:

- Directions to a specific parking area

- Alerts the customer can use to notify staff of their expected arrival

- QR or barcodes that retail staff can use to quickly validate the order curbside.

Shipping notification

Retailers should send a shipment notification after they’ve created a label and sent an order to the carrier. The shipping notification should include the name of the shipping company, the shipping identification number, (preferably hyperlinked to reduce effort on the customer side), and the estimated delivery date.

(Personalized shipping notification emails—those that include the customer’s name or order number in the subject line—have 8% higher open rates.)

Next-day or same-day delivery alert

Some customers need to make plans to receive a package—especially for high value or temperature-sensitive orders like medication. Even when retailers send initial shipping notifications, it’s helpful to send an additional nudge to remind the customer that a package will arrive either the next day or later the same day. Those reminders can help the customer adjust their schedule, reschedule a delivery, or enlist a neighbor to take a box inside.

(In 2021, 64% of Americans were victims of “porch pirates.” Incoming package reminders could be the difference between a seamless delivery and an angry customer service call.)

Delivery variances

Retailers shouldn’t inundate customers every time a package moves, but they should send an update upon learning a package is delayed or will arrive early. Weather and supply chain delays happen, but notifying a customer as soon as possible can ease the frustration.

Of course, sometimes a customer misses the courier. Pinging the customer with a missed delivery notification lets them avoid the stress of tracking down the package, and gives them an opportunity to set a new delivery date or location.

(Services like Narvar Monitor give retailers deeper insights into their logistics networks, helping them predict and communicate delivery variances.)

Feedback requests

Positive product reviews drive sales. Nearly two-thirds of shoppers consider online reviews in their decision process, and retailers that include a “star rating” of 3 or higher on product detail pages see more purchases than retailers who don’t include a star rating.

Customers may need prompting to review their purchases, but 77% are willing to leave a review if asked. Most customers need time to form an opinion about a product before they feel comfortable writing a review, so retailers should wait between one week and one month after delivery to ask customers to submit a review.

Beyond increasing future sales with unbiased feedback, retailers who solicit customer reviews have an opportunity to resolve any problems an existing customer may have with a purchase. Retailers should implement a one-to five-star rating system—in addition to asking customers for specific feedback on their delivery experiences—and always reach out to customers who share poor feedback. By turning a suboptimal experience into one that’s personal, authentic, and thoughtful, retailers can surprise and delight even the unhappiest of customers.

(Set up smart rules to target customers who express satisfaction with the operational side of their experience for detailed product reviews. Customers who experienced back-orders or shipping delays are more likely to rate a product poorly, because the product review is their only channel for publicly airing their concerns.)

Packaging

It may be what’s inside that counts, but packaging is a major opportunity for retailers to showcase their brand, reduce waste, and improve operational efficiency. Ecommerce companies spent $49 billion on packaging in 2020, and 70% of D2C expenses—fulfillment, shipping, returns, etc.— are influenced by packaging.

Meeting expectations for “good” packaging, however, is tricky. Packaging should be sufficient to protect the order during transit, but not excessive. 81% of customers think companies use excessive packaging, and 66% say they consider a company’s eco-friendly shipping policies when making an online purchase.

(Is your company a green packaging superstar? Don’t be shy about those details. Print details like, “This box is made from 50% less material,” or “Old box, new stuff” on your packaging to highlight the steps you’re taking to reduce waste.)

Returns

Many online shoppers make buying decisions based on a retailer’s return policies. More importantly, research shows that 96% of customers would return to a business that offered an “easy” or “very easy” return policy.

The smoothest return is one that allows the customer to decide when, where, and how they complete their returns. That can include:

- Digital returns

- Boxless returns

- Digital-to-physical returns

- Buy online, return in store (BORIS)

- Home pickup

- Standard courier return shipping

Offering multiple options from this list empowers the customer, and increases brand loyalty.

Digital returns

Digital returns bring much of the returns process online—from requesting and processing the return via a returns portal, to directing customers to drop off their items at a designated return point. By eliminating packing slips and return labels from orders in favor of digital returns, retailers save as much as $0.10 to $0.15 cents per package just on printing costs. Plus, the reduced environmental impact of digital returns resonates with eco-conscious customers.

A further iteration of the digital return is the boxless return, which spares the customer the hassle of repacking the item and printing a return label. Boxless returns have spiked in popularity due to their convenience: They save time, they’re cost-effective, and they alleviate common customer complaints, like lack of printer access or available packaging.

Additionally, by collecting boxless returns at a local drop-off location, shipping carriers are able to better optimize their routes and haul multiple packages back to the retailer’s warehouse or distribution center at the same time, reducing emissions.

Digital-to-physical returns

Digital-to-physical returns let a customer buy online, and return items to a physical location. There are several variations on the practice.

- Buy online, return in store (BORIS), which gives the customer the option of returning items to an omnichannel retailer’s brick-and-mortar stores

- Third party drop-off locations, which offer the customer a broad network of brick-and-mortar return concierge points—like drugstores or shopping malls–beyond the store from which they made the purchase

- Home pickup, a white glove service that sends a courier to the customer’s home to pick up a return for a small fee.

(In 2020, 22% of consumers used a pharmacy or locker to make a return, and nearly 33% of customers said they wished they could return items to the nearest store, like a grocery store or convenience store.)

Keep the item returns

If return shipping and processing will cost the retailer more than the value of the returned item—or if the item simply cannot be re-sold—it’s reasonable for the retailer to default to a “keep the item” policy. While 25% of shoppers who were told to keep the item were skeptical of the practice, 65% of shoppers appreciate that retailers are saving them time and effort.

Selective return perks

Despite the prevalence of free returns among major retailers, many customers don’t mind paying a small fee for returns. Retailers can also leverage the timing of returns, or customer loyalty programs to reward certain types of customer actions through a return policy.

For example, Best Buy offers longer return windows for its Elite Plus members, Saks Fifth Avenue offers free return shipping on returns initiated within 14 days of delivery, and Dolls Kill offers free return shipping for customers who opt to receive their refund as store credit.

Customer service engagement

From product inquiries to quality issues, customer service agents need to satisfy shopper complaints in a timely, efficient manner. Customer service interactions—whether by phone, text, email, or chat—should be friendly, conversational, and efficient. Before concluding a customer service call, the agent should always confirm with the customer that the customer’s question or concern has been adequately addressed.

“Where is my…” interactions

“Where is my order?” (WISMO) and “Where is my return?” (WISMR) costs surge when a customer initiates an order or return, and can’t locate information about where the order is in the fulfillment process. Proactive communication can eliminate most WISMO and WISMR queries.

For outbound purchases, the best practice is to alert the customer:

- When an order is confirmed

- When it is shipped

- If/when a delivery variance occurs

- When it is delivered

For inbound returns, retailers should confirm with customers:

- When a return has been initiated

- When it has been received by the courier

- When it arrives at the warehouse

- When the merchandise has been processed for a refund.

A processed return confirmation should include the amount the customer will be refunded—clearly detailing any return shipping or restocking fees—as well as the return form of payment, and when the customer can expect the refund.

If a customer does reach out with a WISMO or WISMR query, a retailer should solicit feedback at the end of the interaction to determine if they have answered all of the customer’s questions. That could be a simple call or chat inquiry, or an automated email requesting star-rating feedback for customer service.

Follow-Up Messaging

A retailer’s probability of selling to a return customer is 40% greater than that of selling to a new customer, and repeat customers spend 31% more than new leads. Once a retailer has a customer, they should be strategically leveraging their communication channels to build the relationship and encourage the customer to make another purchase.

For more complex products, that could mean onboarding tutorials for the customer. Sonos, for example, reaches out to customers about creating an account, downloading the app, and custom tuning with Trueplay to get the customer excited about their order and promote a positive experience.

Follow-up targeting isn’t a random money-grab. Retailers can use the information they’ve gathered from past orders or site cookies to make suggestions about other items the customer might like, or remind the customer when their supply of an exhaustible item might need to be replenished.

That could include:

- Making suggestions for clothing items or accessories to complement a fashion purchase

- Recommending products to extend the life of the original purchase, (i.e. leather protector for a bag, or a travel case for electronics)

- Refill of food, healthcare, or skincare products given their expected duration.

Remember, keeping a customer is 5X cheaper than acquiring a new one. A 5% increase in customer retention can increase a retailer’s profits by 25% to 95%. Instead of viewing a “purchase” as the end-goal in a transaction, retailer’s should approach post-purchase experience as the start of a customer relationship.

(Looking for ways to improve your post-purchase experience?—Explore Narvar’s full content library.)

Get more insights from the experts

GET STARTED

Power every moment after the buy

Build trust. Protect margins. Drive growth — “Beyond Buy.”