AI-powered delivery date estimates to boost conversion

Give shoppers peace of mind and protect and grow your bottom line

Personalized tracking experiences to build brand loyalty

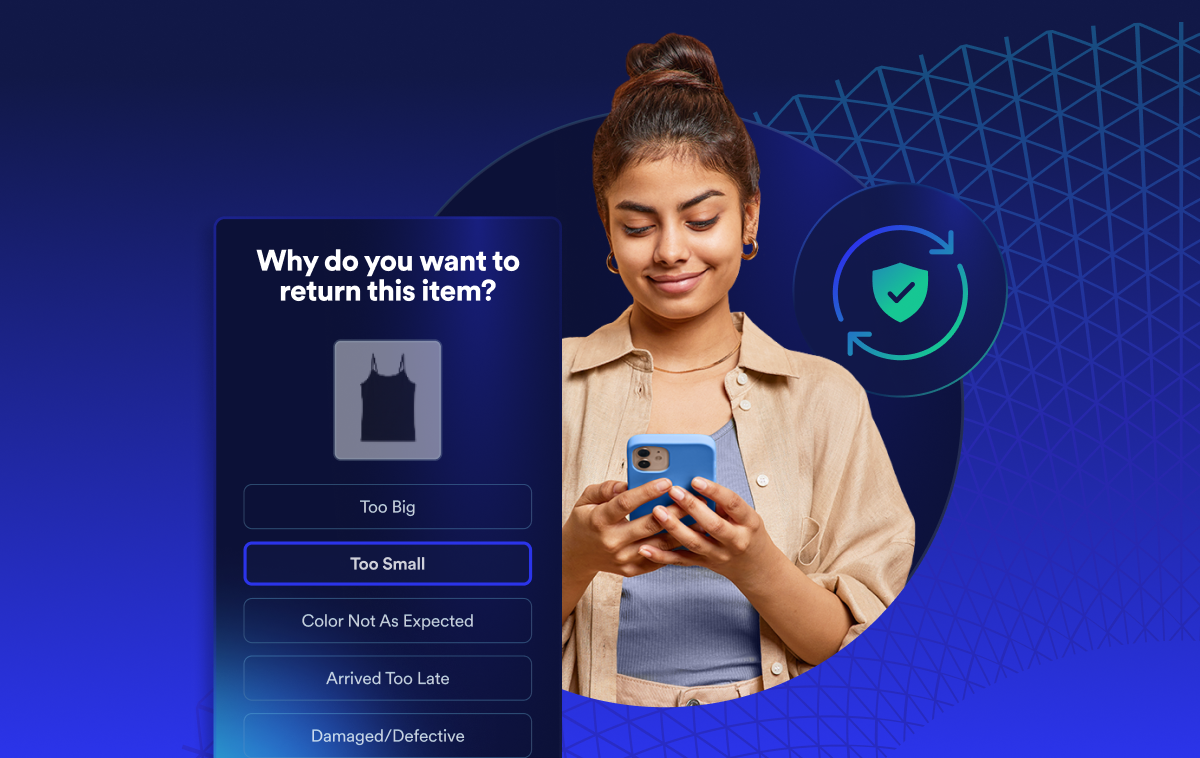

Returns and exchanges management to mitigate fraud and reward best customers

Proactive communication to drive customer lifetime value

Delivery claim management to tackle fraud and build trust

Luxury Retailers Bridging Ecommerce and In-Store

It was once assumed that consumers would not buy luxury items online. Yet, online luxury sales are expected to triple by 2025 and reach $91 billion, while roughly 20% of all personal luxury sales—more than double what the category has recently seen—will take place via digital that year.

There is no time like the present for this category’s digital transformation: Today, online experiences already impact 40% of luxury purchases. The luxury consignment market is also proving to be lucrative, as The RealReal was valued at $1.2 billion last year after less than a week of public trading. With all of that in mind, here are three components that should be in every luxury brand’s playbook.

Make shopping easier like a D2C brand

We’ve seen early hints of luxury brands supplementing store experiences with digital tools (or vice versa) that serve customers. A mix of ecommerce initiatives from companies like fashion giant Gucci, watch brand Jaeger-LeCoultre and carmaker Tesla have emerged.

“Ordering your Tesla is just like any buying experience on the Internet,” reads Telsa’s website. The brand’s electricity-powered cars cost up to $124,000.

These companies are following the previously-unconventional trends set into place by direct-to-consumer (D2C) brands, which focus on being channel agnostic across physical and digital platforms rather than being “multichannel.”

That’s why it wasn’t shocking when news recently broke that the cosmetics conglomerate Coty, owner of Coty Luxury, may buy Kylie Jenner’s online startup Kylie Cosmetics. Dating back to Unilever purchasing Dollar Shave Club for $1 billion in 2016, there’s been a wave of D2C acquisitions by legacy companies which are recognizing the success of this seamless approach, and luxury brands should take note.

Luxury shoppers, whose average purchase is $2,500, will expect only the best throughout their digital experience. Luxury brands need to make everything from product discovery to package delivery, order tracking, and returns as convenient as possible.

These are areas where they can learn from D2C players that meet their customers where they are. As one example, Rent the Runway, the designer clothing rental service, is partnering with WeWork locations to give customers more convenient options for returning their shipments.

Last summer we launched Narvar Concierge, which helps brands leverage a network of locations close to consumers including select Nordstrom stores, for pick up and returns.

Millennials love direct-to-consumer brands, and that age group will make up 40% of the luxury sales by 2025.

Utilize first-party data

Brands like Rent The Runway, StitchFix and TUMI are combining digital tools with brick-and-mortar stores to learn about their customers and offer individualized experiences. They use data to understand customers while blurring the lines between channels.

It’s retail 3.0, and it’s another area where luxury brands can embrace ecommerce in a way that serves high-end consumers. Take luxury clothier Threads, which uses WeChat and WhatsApp extensively to serve its customers, who are typically under 35 years old and spend $3,000 per purchase.

The ways in which the brand accomplishes such an impressive average order size include personalizing the customer experience with concierge-style services, including tech features like streamlined order tracking and a cutting-edge search engine.

Connect digital to physical

The importance of providing a customer experience that meshes digital with physical presence right now cannot be overstated.

In a move that offers a touch of old-world Hollywood glamour, Rent the Runway is experimenting with bringing the closet to their customers with their new W Hotels partnership, piloting in select locations including Aspen and Miami's South Beach. Guests can order pieces from an assortment curated especially for that location, to be provided during their stay and conveniently returned at the front desk upon check out.

M.Gemi, a company that sells handcrafted Italian shoes, is the latest D2C brand to launch “fit shops,” with the brand opening locations in New York City and Boston. (Bonobos and Warby Parker are a couple of its predecessors who launched experiential storefronts to drive their brands.) Customers can book a consultation online or simply walk into a store, where they’ll receive VIP treatment with glasses of champagne and early access to the shoe brand’s newest styles.

Even though M.Gemi focuses on digital sales, these fit shops provide the brand with valuable touchpoints and give the company sources of first-party data to inform product design, inventory planning and customer service. It’s an elegant, smart example of connecting digital and physical experiences.

Going forward, play the long game

It’s imperative that luxury brands draw inspiration from digital-first retailers to find new ways to engage with high-end consumers across channels. Consider that millennials love direct-to-consumer brands, and that age group will make up 40% of the luxury sales by 2025.

Resolve will also be key. It’s going to be important for the luxury category to invest in bridging online to offline for the foreseeable future.

Indeed, luxury consumers will increasingly shop both digitally and in stores. Brands that connect the dots of customer behavior between online and physical will be well-positioned.

The ones that also replicate the traditional, high-touch experience—which has taken place offline, historically—in digital channels will beat the competition for years to come.

A version of this article was originally published in Luxury Daily. Find out how luxury brands make Narvar part of their digital playbook.