AI-powered delivery date estimates to boost conversion

Give shoppers peace of mind and protect and grow your bottom line

Personalized tracking experiences to build brand loyalty

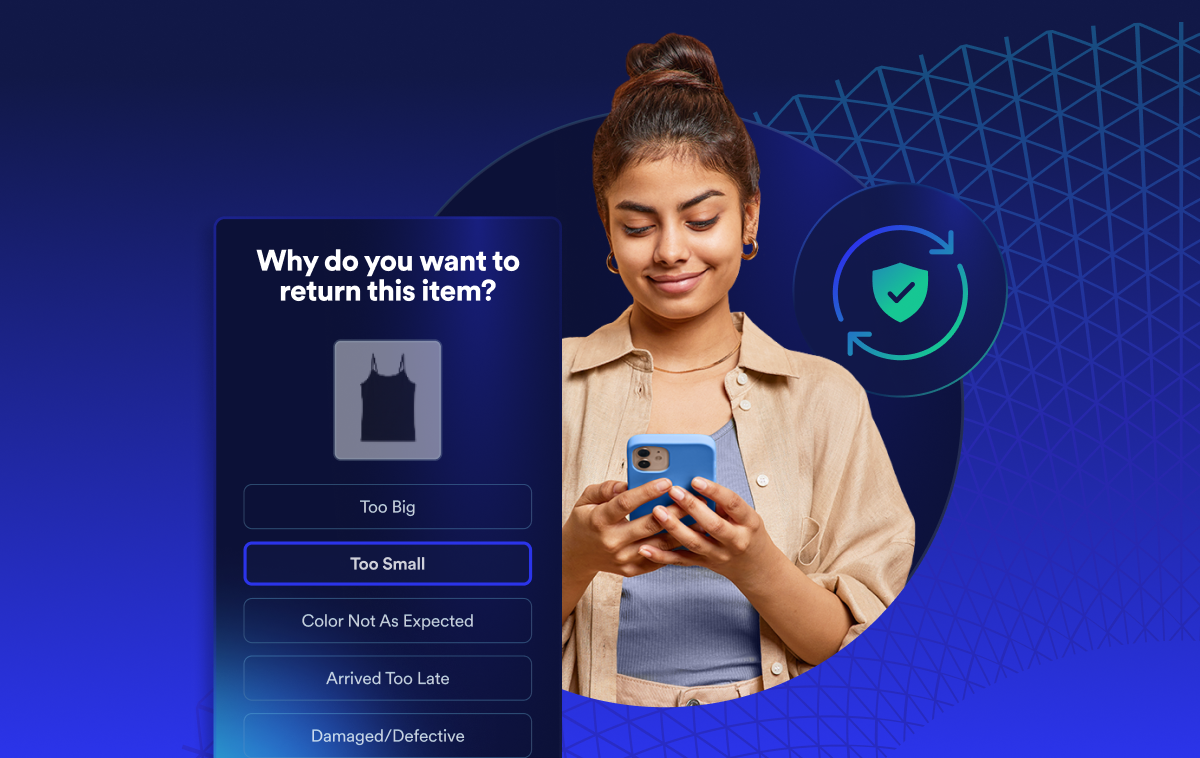

Returns and exchanges management to mitigate fraud and reward best customers

Proactive communication to drive customer lifetime value

Delivery claim management to tackle fraud and build trust

What Is Reverse Logistics? Definition, Examples, and Solutions

%20(9).webp)

With more e-commerce returns getting processed each year, it's critical for supply chain professionals to get a strong handle on their reverse logistics program. Last year, for example, the average retail brand processed $166 million in returned merchandise for every $1 billion in sales, with 20.8% of online purchases being returned. In this article, you’ll learn reverse logistics best practices for retailers, including return initiation, consolidation, intelligent dispositioning, and collecting data to inform future decisions.

What is reverse logistics?

Reverse logistics is the process retailers use to receive unwanted or damaged items (also known as returned items) back from their customers, and then properly accepting and dispositioning the items, either by restocking, selling to wholesalers or outlets, recycling, disposing, etc.

In technical terms, reverse logistics is a part of supply chain management. It allows for purchased goods to go backwards from the end customer all the way back to the original manufacturer if need be.

While this article will focus on reverse logistics as it relates to the return of resalable goods by customers in retail, other forms of reverse logistics include the return of unsold goods from brick-and-mortars to distribution centers, the return of product trade-ins (e.g., trading in an iPhone 11 for an iPhone 13) for refurbishment and resale, recycling/disposing of goods (e.g., an opened moisturizer), and more.

What is the goal of reverse logistics?

The goal of any reverse logistics process is two-fold:

- Protect revenue by mitigating waste and inefficiency in the returns process

- Recoup as much of the value of the item being returned as possible by way of resale

When done well, reverse logistics improves the shopper experience, boosts customer loyalty (which fuels future sales), salvages revenue (via product resale), and protects profitability (through lower storage and distribution costs) which is a win for both the retailer and the customer.

Why is reverse logistics important?

Reverse logistics ensures that the right products go to the right distribution centers and get back into the supply chain as soon as possible. When reverse logistics policies and processes are on solid footing, they cut costs, maximize profits, increase sustainability, and improve the customer experience.

Historically, returns have been initiated either by contacting a retailer’s customer service center for a return merchandise authorization (RMA), bringing unwanted merchandise back to a brick-and-mortar store, or using a pre-printed return request and shipping label.

Digital returns upended those traditional channels by allowing retailers to see when and which products will be reentering the supply chain in real time. Using a branded online portal that uses rules engines to streamline the execution of complex return policies, customers can submit their return requests to retailers directly. Retailers can then use those insights to direct returns to destinations in need of inventory.

Types of inbound returns

From a customer experience perspective, the smoothest return is one that allows the customer to decide when, where, and how they complete their returns. That can include:

- Traditional return shipping

- Buy online, return in store (BORIS)

- Digital returns

Let’s review the advantages and disadvantages of each type of return through a reverse logistics lens.

Traditional return shipping

The packing-slip-and-enclosed-shipping-label approach to returns saddles both the retailer and the customer with the most challenging experience possible.

By including a return shipping label in every order, retailers are incurring extra costs on orders that aren’t returned. They are also more likely to be caught off-guard when a customer decides to make a return, because the retailer’s initial notice of the return occurs when the item is scanned into the courier’s tracking system.

The retailer has no information on the number of items being returned or the reasons for return, so it can’t make resale decisions until the package is received and processed. While customers may indicate a “reason code” for the return on the packing slip, there’s no guarantee that they will complete the packing slip correctly. This outdated approach to shipped returns creates a data void that forces the retailer to make slower or less-informed inventory decisions.

Paper packing slips also leave the customer guessing as to when they might receive a refund. Unless the customer keeps a copy of the return tracking number and manually types it into the courier’s website, they won’t know where the return is, or when to expect a refund. Those blind spots lead to where is my return (WISMR) customer service inquiries, which can cost the retailer up to $6 per call.

Buy-online-return-in-store (BORIS)

Customers love the convenience of BORIS—62% are more likely to make an online purchase if they can return it in a brick-and-mortar store.

For retailers, BORIS eliminates expensive return shipping fees and WISMR inquiries, while minimizing markdowns. When customers return items that are stocked in store, the retailer can immediately restock a returned item in resalable condition on the sales floor, increasing the likelihood of a higher resale price.

On the flip side, retailers can’t plan for when an item will arrive in a store, (beyond the return window), and can’t dictate which brick-and-mortar the item is returned to.

Most BORIS transactions also miss the mark on customer feedback because few retailers allow shoppers to initiate a BORIS return online. The team member accepting the merchandise might ask, “Was there anything wrong?” to determine if the item is in saleable condition, but fail to ask questions about sizing or quality. While it’s reasonable for an associate to limit questions to ensure a great customer experience, that means the retailer is left without useful data.

Digital returns

Digital returns give the customer control over how they want to facilitate the return (i.e., third-party shipping, digital-to-physical returns, home pickup,) and give the retailer insight into the customer’s behavior and preferences. Digital returns can include boxless returns, printerless returns, and keep-the-item returns.

The common thread for digital returns is…

- The customer alerts the retailer of their intention to return

- The customer explains their reason for initiating the return

- The retailer provides access to return instructions (print-at-home labels, QR codes, drop-off locations, etc.)

For the customer, the benefit is the entire digital return process can be managed online at their convenience. Similar to shipping notifications on outbound orders, the customer can be alerted through their preferred communication channel, (email, text, or push notification) of both their return and refund status (“in-transit”, “scanned at warehouse”, “refund issued”, etc.) eliminating the need for costly WISMR inquiries.

For the retailer, a digital return offers flexibility in directing the item to the destination where it can generate the most revenue. If a digital return triggers a keep-the-item policy, it can also save the retailer money on return shipping and processing.

Additionally, detailed reasons in the digital RMA process help retailers adjust their product pages (for items that are currently being sold through the website), reevaluate manufacturing relationships, and make better product recommendations to their customers.

Removing friction from returns

The faster a retailer receives a return, the more likely they are to resell the item at full price. Retailers can drive customers to return items faster by eliminating obstacles, incentivizing speed, and communicating more clearly.

- Eliminate obstacles: Offer the customer a range of options for returns, including in-store, drop-off, and pick-up, as well as printerless and box-free returns.

- Incentivize speed: Create tiered return perks to encourage earlier returns, (e.g., free return shipping within 14 days, and paid return shipping between 15 and 30 days; discounts on future purchases as a reward for fast returns).

- Communicate clearly: A retailer should clearly explain the return process on their website, and, again, in every post-purchase notification that goes out to the customer.

Consolidation

Consolidation is both a cost-cutting measure and a pillar of every retailer’s ESG strategy.

One of the easiest ways a retailer can execute a consolidation plan is to accept boxless returns in a digital-to-physical return program. By grouping returns locally into bulk shipments, retailers eliminate unused space in truckloads—cutting costs and reducing emissions at the same time.

There are three paths to returns consolidation:

- BORIS gives the customer the option of returning items to the retailer’s brick-and-mortar location, and lets team members either consolidate return shipments to a different warehouse or redirect items to the sales floor.

- Home pickup saves the customer the trouble of boxing and dropping off the return, and allows a third party to triage a returned item to a designated destination.

- Digital-to-physical returns through couriers or concierge points let staffers bundle items heading to the same location into fewer shipments.

Intelligent dispositioning

Knowing why and when a customer is making a return can inform dispositioning rules and increase a retailer’s profits.

- If customers are bracketing to find their best fit, returned items in new condition can be redirected to a storefront in a location where they’re in high demand for faster resale.

- In the case of merchandise going out of season, returns data can trigger rules to send items to an outlet store where they’re more likely to be resold.

- If the customer reports that an item arrived damaged or broken, the retailer can offer a keep-the-item refund.

- For VIP customers, retailers can automatically deploy perks like free return shipping or instant refunds.

Beyond directing categories of products to specific locations, intelligent dispositioning rules allow retailers to localize returns to closer 3PL warehouses, reducing the time and cost of shipping, speeding up refunds, and returning inventory to shelves faster.

Processing returns

A retailer often waits to receive and review a returned item before issuing a refund, but that’s not the only approach. Offering an instant exchange or credit at the time the customer initiates a digital return is an increasingly popular way to increase satisfaction and recapture revenue.

Levi’s, for example, deployed Narvar’s printerless returns and online exchanges to minimize revenue loss during the COVID-19 pandemic, leading to a 40% reduction in WISMR and a converting 30% of potential returns into exchanges.

But that’s only one-half of the equation. While customers enjoy instant refunds and credits, retailers need to incentivize customers to return their unwanted items as soon as possible, and then process those returns quickly on the receiving side.

The shipping side of dispositioning is centered on where a return should be directed. But processing is dedicated to how an item should be handled upon its return, and it’s a largely manual endeavor.

The good news is that work can be outsourced. Retailers can utilize 3PL returns management providers to handle returns processing on a local level—including repackaging, relabeling, and refunds—to get merchandise back into inventory.

Faster processing means faster refunds, which means happier customers.

Utilizing returns data to drive sales

Data collection during the return process is critical. It can shine a light on quality control issues, or track changing consumer tastes and behaviors. Used correctly, it can help retailers minimize returns and fuel more sales.

For example, if the most common return reason is “the item was too big”, a retailer can update the product detail page with a note for shoppers that says “this item runs large.” By warning customers about sizing issues at the front-end of a transaction, the retailer can reduce the likelihood of a return long-term.

Returns data gives retailers actionable insight into the accuracy of product descriptions, manufacturing and material quality, and customer behavior. Retailers that use a branded online portal to manage returns gain real time insight into why customers are making returns, and can adjust their strategies accordingly.

Final comment on reverse logistics and returns

Customers crave immediacy, whether it’s lightning fast shipping or speedy returns. Five years ago, it took more than two weeks for most customers to get a return. Now, thanks to 3PLs and intelligent dispositioning, customers can have refunds in under a week.

Returns are a critical part of the customer experience in retail, and they have a direct impact on a customer’s LTV: 48% of consumers say they will not shop again with a retailer after a poor returns experience, while 96% will return to a business that offers an “easy” or “very easy” return policy. As Amazon continues to skew perspectives on what a reasonable shipping or return period looks like, the rest of the retail sector has to find ways to keep up.

Retailers of all sizes trust Narvar to deliver world-class reverse logistics strategies. Want to learn how your company could maximize its returns process? Schedule a demo today.

Get more insights from the experts

GET STARTED

Power every moment after the buy

Build trust. Protect margins. Drive growth — “Beyond Buy.”