AI-powered delivery date estimates to boost conversion

Give shoppers peace of mind and protect and grow your bottom line

Personalized tracking experiences to build brand loyalty

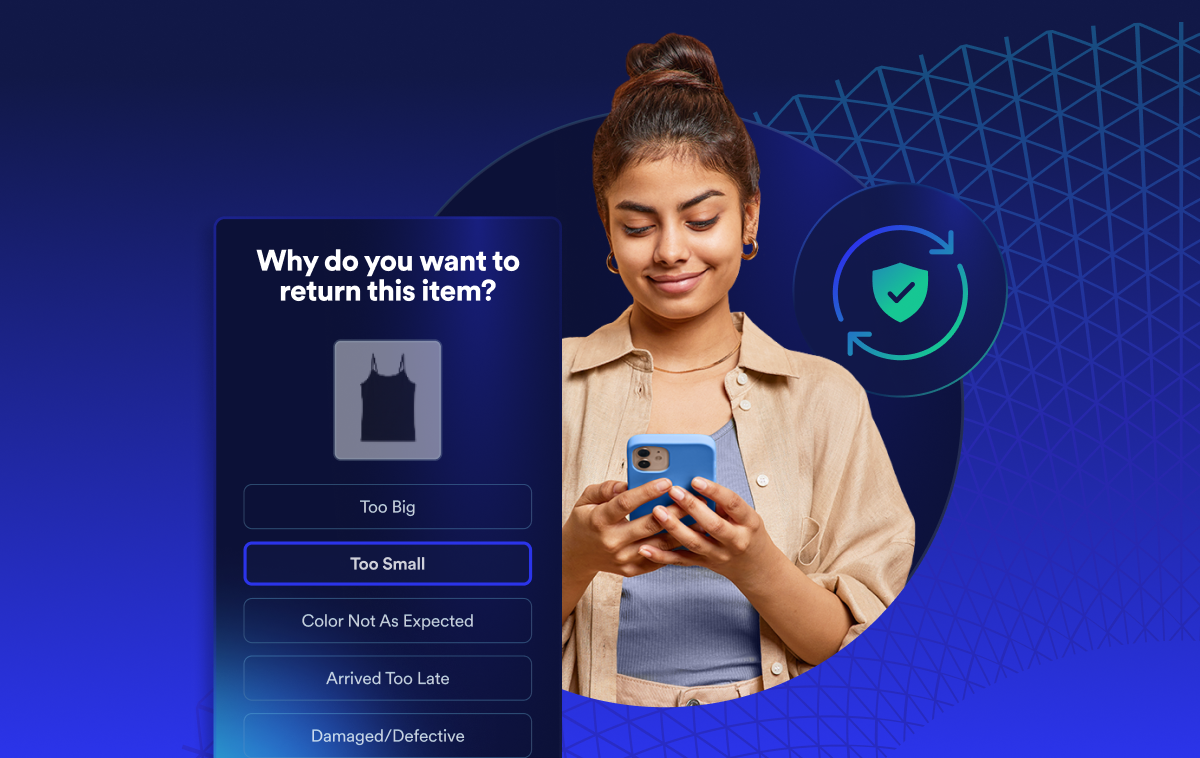

Returns and exchanges management to mitigate fraud and reward best customers

Proactive communication to drive customer lifetime value

Delivery claim management to tackle fraud and build trust

Logistics Operations and Ecommerce

With a respectful nod to Mark Twain—who popularized that memorable, if somewhat jaded, assessment of the science of data analytics—the business world these days runs on information.

Gartner forecasts the current incarnation, Business Intelligence (BI), to reach a market size of $22.8 billion in 2020, up from $18.3 billion in 2017. That’s a lot of hard-won revenue and margin being invested into the hope that the right information will drive the top and bottom line in ways that only clarity of insight can provide. There are, of course, good reasons for this.

Information allows us to identify opportunities to drive revenue by illustrating market trends, unforeseen demand, and potential synergies. We can also spot trouble brewing before it blows up into a full-blown crisis, and tweak the processes to drive efficiencies across the broad scope of business operations.

The explosion in data over the past couple decades (456, 000 Tweets a minute in 2017—see statistics can be fun!) quickly runs into a problem, though: Us.Let’s face it, we all have a great deal to accomplish in our professional (not to mention personal) lives. That means we only have so much time we can spend looking at and understanding numbers.

The promise and perils of AI—BI’s smarter, scarier big brother, Artificial Intelligence—aside, we have to make countless conscious and unconscious decisions all day, every day relative to what we pay attention to in the non-stop stream of information coming our way. Knowing about it is then only half the battle—we also have to do something about it if the investment in information and time is to have any value.So, what to do, what to do?

First and foremost, start big. If we have a hundred and one statistics we use to gauge the health of our operations, we find ourselves quickly in a state of analysis paralysis.

Every company, and every operation, has unique value propositions and therefore performance indicators (aka KPIs) that are more critical than others to their business.

That said, the universal and single most important is also the simplest: What did I tell my customer I was going to do and how well am I doing it? In the world of logistics, this is better known as on time to commit.

(Putting aside the complexities of the ‘perfect order’ and its attendant stock and pick accuracy components).

There is not an ecommerce customer out there who doesn’t want to understand when their order is going to be delivered at the time they check out.

How well our supply chain fulfills that expectation trumps all other data and should be known and understood by every individual in at least the logistics organization.

There is not an ecommerce customer out there who doesn’t want to understand when their order is going to be delivered at the time they check out.

Next, prioritize in two buckets:

- Which set of orders can we do something about right now to save a customer experience?

- Which set are more useful for post-mortem analysis?

It’s the orders in transit with the ability to interdict that are far more critical. These shipments are just as much opportunities as they are problems.

Using various trigger points across the lifespan of an order, we can see where they become at-risk or even fail before the customer knows about it.

If we have and react to these data points, best case we can actively intervene and save a critical customer experience.

Worst case, we can communicate to a client before a disappointing experience to perhaps soften the blow.

Now for that backward-looking, but still important, analysis. Again, we don’t want to overload on statistical data we use to quickly view the health of our operation, but we should broaden our view. Here, we also want to make use of objective and subjective information.

The objective information is the what, where, and when of on-time call center volume and other order life-span capture points (ie. just how many weather events can Atlanta possibly have?). The subjective information is the feedback you get from the customers, in the form of surveys, driver ratings, and verbatim call detail. Both are important, but the most polished KPIs are poor defense against a dissatisfied customer base.

If the one does not support the other, it likely means we have the wrong objective statistics. This is not to say that there is not a need and tremendous value in deeper dives into operational data. Especially for fast-evolving and low-margin industries such as ecommerce, there are opportunities to be found and advantages to be exploited lurking in the depths of statistical analysis.

Consulting organizations can provide broad insight and guidance, academic institutions such as MIT Megacity Logistics Labs and Georgia Tech Logistics Innovation Centers offer cutting edge research, and BI tools can accelerate the time and cut the cost while making sense of millions of data points.

But in terms of managing the day-to-day business of ecommerce logistics, with its myriad demands and time constraints, a straightforward view of a select few key service indicators, prioritized by proactive visibility points and subjective customer feedback, drive the most immediate and positive impact.

This article was originally published on LinkedIn.com.

.webp)